Option Greeks Explained: A Strategic Breakdown for Day Traders

Some of the most common questions new traders ask is, “What do the option Greeks mean?” and “How do I use Delta and Theta when trading options?” There are five main metrics that help you determine how time decay, price movement, and volatility shifts impact your trades. As an investor, options trading requires more than just spotting setups, it demands a deep understanding of how price, time, and volatility shape the value of an option. This is where the Option Greeks come into play. The Greeks are not just academic theory; they’re the live data that traders use to assess probability, risk, and reward in real-time.

If you're trading options and you're not using the Greeks to manage your positions, you're essentially making moves without context. If you’ve been searching for how to read option Greeks for beginners or how to use the Greeks in options trading, this breakdown gives you the real strategy behind the data, not just definitions. Let’s jump into a complete, fact-based breakdown of the five core Greeks: Delta, Gamma, Theta, Vega, and Rho, what they measure, how they behave, and what they mean for your trading plan.

DELTA: The Directional Guide

Definition: Delta measures the rate of change in an option’s price relative to a $1 change in the underlying asset.

Range:

Calls: Have a range of 0 to +1 (zero to one).

Puts: Have a range of 0 to –1 (zero to negative one).

Examples:

A call option with a delta of 0.50 means the option will gain $0.50 for every $1 increase in the stock price.

A put option with a delta of 0.50 means the option will gain $0.50 for every $1 decrease in the stock price.

Why Delta Matters

Directional Bias: Tells you how much your option behaves like the stock. A delta of 1.00 = synthetic stock ownership.

Probability Proxy: Traders use delta as a rough estimate of the option expiring in-the-money (e.g., 0.30 delta = 30% chance of finishing ITM or 0.80 delta = 80% chance of finishing ITM).

Position Sizing: Helps calculate portfolio exposure. Five contracts with 0.50 delta = 250 share equivalent.

GAMMA: The Rate of Acceleration

Definition: Gamma measures the rate of change of delta per $1 move in the stock. Think of it as delta’s best friend, as it follows the momentum.

Gamma is highest for at-the-money options and increases as expiration approaches.

Why Gamma Matters

Risk Management: High gamma means delta can swing fast, great for quick profits but also exposes you to rapid changes.

Gamma Scalping: Advanced traders hedge changing deltas to profit from volatility around a price level.

Short Options Risk: If you're short near-the-money options with high gamma, price moves can snowball losses fast.

THETA: The Time Decay Factor

Definition: Theta estimates how much value an option loses each day, assuming all else stays constant.

Theta is always negative for options.

Example:

Theta = –0.07 means the option loses $0.07 x 100 = $7 in value daily.

Why Theta Matters

Time is Not on Your Side (as a buyer): Long options lose value with each passing day.

Sell-Side Edge: Theta decay favors option sellers, especially in high implied volatility environments.

Decay Accelerates: Theta erosion speeds up in the final 30 days before expiration, especially for at-the-money contracts.

VEGA: The Volatility Translator

Definition: Vega measures how much an option’s price changes with a 1% change in implied volatility (IV).

Vega is highest for ATM options and longer-dated contracts.

Example:

Vega = 0.15 means a 1% increase in IV raises the option’s value by $0.15.

Why Vega Matters

Earnings Trades: IV crush post-earnings can wipe out long option value—even when the stock moves in your direction.

Volatility Skew: Out-of-the-money puts often carry higher vega due to downside protection demand.

LEAPS vs. Weeklies: LEAPS (long-dated options) are more sensitive to volatility shifts because they have higher vega.

RHO: The Interest Rate Sensitivity

Definition: Rho measures the change in an option’s price with a 1% change in interest rates.

Rho is more relevant for LEAPS or deep in-the-money options.

Example:

Rho = 0.10 means a 1% rate increase raises the option’s value by $0.10.

Why Rho Matters (Even If Slightly)

Low Impact, Until It’s Not: In a rising rate environment, call options can gain value due to lower present value cost of carrying stock.

Institutional Consideration: Banks and funds with large-scale positions often factor in rho across long-term hedging.

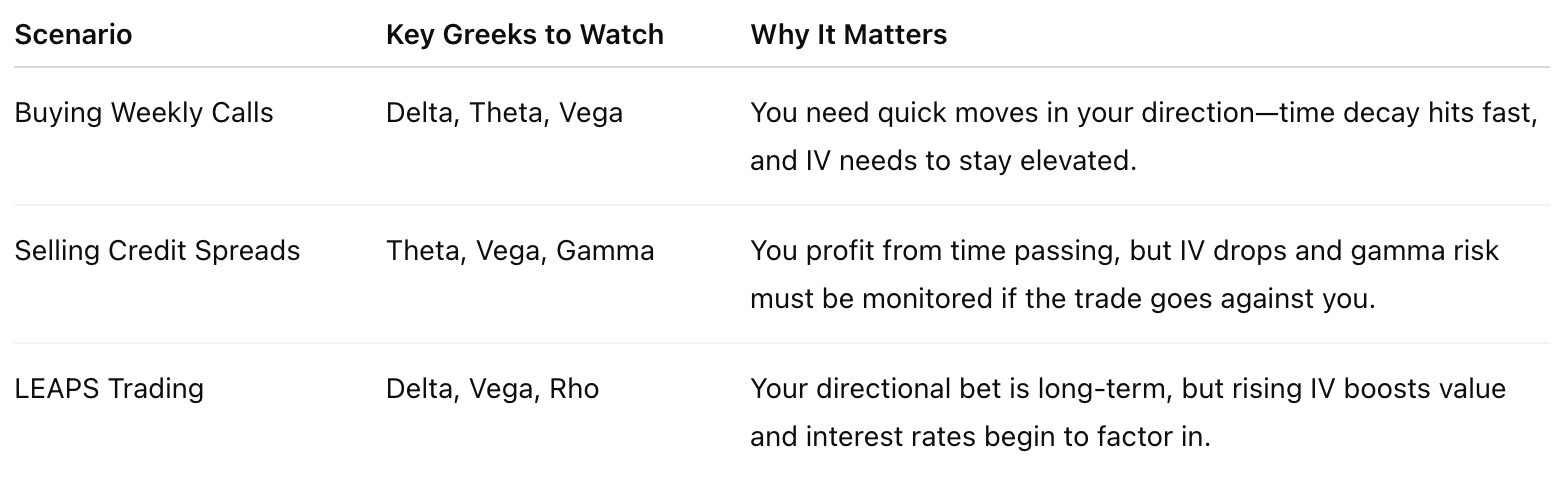

Real World Application: Option Greek Trading Strategy

When managing an option position, these Greeks don’t operate in isolation. They interact and influence each other based on the following:

Option Greeks Offer A Strategic Edge

Mastering the Greeks isn’t just about knowing definitions, it’s about interpreting how they shift together in real-time to shape your risk and reward. A professional trader doesn’t just ask, “Is this option cheap or expensive?” They’re asking:

How fast is Delta changing?

What’s my exposure to volatility crush?

How much decay am I absorbing per day?

Is this position structurally strong over time, or only in the short-term?

Be sure to watch this video for a detailed breakdown and a real-time visual of how everything from this blog plays out in action. Option Greeks Explained for Beginners.

Key Takeaways

Delta = Directional exposure.

Gamma = Rate of delta change (acceleration risk).

Theta = Time decay cost.

Vega = Volatility risk.

Rho = Interest rate sensitivity (low but present).

All in all, options traders refer to “the Greeks” as the core variables that drive options pricing, they quantify how an option is expected to behave in response to changes in market conditions. These numbers help forecast price movement, time decay, and volatility impact so its best not to treat these metrics as secondary, they are your real-time financial radar. Traders who ignore them operate in the dark. Those who study them know where the traps and opportunities lie, before the market moves. For example, knowing how Theta works can prevent you from losing money due to time decay, while Delta helps you project how much your option will move with the stock.

If you’re learning how to trade options, understanding the option Greeks, Delta, Gamma, Theta, Vega, and Rho is essential for building profitable strategies and managing risk.

Writer’s Note

✨ Hi everyone, I appreciate you taking the time to read through this breakdown on the Option Greeks. These concepts are the foundation of how options pricing truly works and how risk is managed at a high level.

Many of you have already heard me say, when you understand the Greeks, you stop trading options aimlessly and start positioning yourself with precision. Delta, Gamma, Theta, Vega, and Rho aren’t just definitions, they’re the language of movement, time, and volatility. And if you’re serious about becoming a profitable trader, you can’t afford to ignore them.

Inside our private trading community, we go well beyond the surface. We break down how Greeks respond in real time, how they shift across expiration cycles, and how to use them to frame winning strategies that adapt to market conditions. This is strategic execution, not speculation.

If you’re ready to move from guessing to structured positioning, especially when trading weeklies, earnings setups, or managing swing trades, you’ll want to access our hub. Discord is where strategy meets clarity, with curated watchlists, live trade reviews, and real-world application of what most overlook is discussed.

And if you desire to have trading replace your full time job? The VIP Apprenticeship is where that shift happens. I walk you through my full options framework, from entry models to risk management to scaling, and help you build a six-figure approach grounded in skill and consistency.

This isn’t about chasing premiums. It’s about mastering the techniques that move the options market.

Let’s elevate how you trade. All love!

—Star 🤍